In what has to be one of the most ridiculous displays of a shameless “party line” style coordinated spin, the Massachusetts Association of Realtors (MAR) has decided to simply “cop” the exact lingo put forth by its national counterpart, the National Association of Realtors (NAR), when addressing the outlook for housing.

In what has to be one of the most ridiculous displays of a shameless “party line” style coordinated spin, the Massachusetts Association of Realtors (MAR) has decided to simply “cop” the exact lingo put forth by its national counterpart, the National Association of Realtors (NAR), when addressing the outlook for housing.Examine the following statements found in two separate “existing home sales” reports (one for the nation by NAR, the other for Massachusetts by MAR) released Thursday:

NAR President Pat Vredevoogd Combs:

“Mortgage interest rates are the lowest they’ve been since January… This is increasing buying power at the same time that sellers are showing a willingness to negotiate price and terms. Combined with a plentiful supply of homes on the market, there’s a window for buyers now…”

MAR President David Wluka:

"With home prices leveling, interest rates remaining low, inventory still plentiful and more sellers accepting market-based pricing, Bay State homebuyers have a special window of opportunity right now,”

If that wasn’t ridiculous enough, Wluka adds this additional scare tactic directed at first time home buyers:

“We just don’t know how long the window will stay open, with factors remaining so favorable. For anyone trying to time the market, the waiting game may be a big mistake.”

Hopefully MAR’s unabashed use of association “talking points” to coax and even scare buyers back into a market that is exhibiting some of the worst housing numbers in the country will show them for being self serving and further discredit an institution that long ago traded its integrity for ephemeral gains.

As with last month, its important to note that the impact of the housing slowdown has been so significant that Massachusetts is now poised for the greatest yearly sales drop of single family homes in at least the 17 years that sales have been charted.

November's 12.6% sales drop brings the current years total of single family home sales to only 38,539, well below the 45,385 total for the first 11 months 2005.

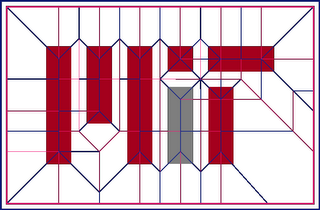

Review the following chart:

As you can see, Massachusetts is headed for roughly 41,689 total single family home sales for 2006 and that’s with a fairly optimistic projection of only a 10% sales decline for December.

The following chart demonstrates what this drop off would look like in the context of single family home sales since 1990. Click on it for a larger, more readable version.

As in months past, be on the lookout for the inflation adjusted charts produced by BostonBubble.com for an even more accurate "real" view of the current market trend.

Key Statistics for November 2006

- Single Family Sales down 12.6% as compared to November 2005

- Single Family Median Price down 4.0% as compared to November 2005

- Condo Sales down 13.6% as compared to November 2005

- Condo Median Price up 1.6% as compared to November 2005

- Single Family average “Days on Market” now stands at 130 days in November as compared to 95 days for November 2005

- Condo average “Days on Market” now stands at 121 days in November as compared to 85 days for November 2005

- Inventory of single family homes have risen for 21 consecutive months and now stands at 35,254 units listed on the market through MLS. This represents 10.9 months of supply.

- Inventory of condos now stands at 17,851 units listed on the market through MLS. This represents 12.7 months of supply.

housing+bubble realtor massachusetts MAR NAR association+of+realtors David+Wluka economy housing recession home+sales median+price real+estate decline

Copyright © 2006

PaperMoney Blog - www.paperdinero.com

All Rights Reserved

Disclaimer

Copyright © 2006

PaperMoney Blog - www.paperdinero.com

All Rights Reserved

Disclaimer