Showing posts with label homebuilder. Show all posts

Showing posts with label homebuilder. Show all posts

Monday, July 18, 2016

NAHB/Wells Fargo Home Builder Sentiment: July 2016

Today, the National Association of Home Builders (NAHB) released their latest Housing Market Index (HMI) showing that overall assessments of housing activity generally worsened in July with the composite HMI index remaining declining to 59 while the "buyer traffic" index declined to a level of 45.

Wednesday, June 15, 2011

Homebuilder Blues: NAHB/Wells Fargo Home Builder Ratings June 2011

Today, the National Association of Home Builders (NAHB) released their latest Housing Market Index (HMI) showing declines across every measure with the "future conditions" component falling to the historic low while the "buyer traffic" index remained near record lows as home builders continue to plod through the weakest activity seen in generations.

Today, the National Association of Home Builders (NAHB) released their latest Housing Market Index (HMI) showing declines across every measure with the "future conditions" component falling to the historic low while the "buyer traffic" index remained near record lows as home builders continue to plod through the weakest activity seen in generations.It's important to recognize that currently all measures are showing notable declines in the level of activity seen since last year.

Clearly the new home market has seen another no-show start to the buying season with the typically strongest selling months (remember Bob Toll's analysis of the seasons) fully behind it.

The new home market will likely not resume any significant form of healthy function until the considerable overhang of inventory is cleared.

Tuesday, March 15, 2011

Homebuilder Blues: NAHB/Wells Fargo Home Builder Ratings March 2011

Today, the National Association of Home Builders (NAHB) released their latest Housing Market Index (HMI) showing a flattening for most measures with the "buyer traffic" index remaining near record lows as home builders continue to plod through the weakest activity seen in generations.

Today, the National Association of Home Builders (NAHB) released their latest Housing Market Index (HMI) showing a flattening for most measures with the "buyer traffic" index remaining near record lows as home builders continue to plod through the weakest activity seen in generations.It's important to recognize that currently the HMI index is showing a slight year-over-year gain but still remains very near the lowest levels seen in over 20 years, a testament to the significance of the latest pullback.

The new home market will likely not resume any significant form of healthy function until the considerable overhang of inventory is cleared.

Monday, May 18, 2009

Homebuilder Blues: NAHB/Wells Fargo Home Builder Ratings May 2009

Today, the National Association of Home Builders (NAHB) released their latest Housing Market Index (HMI) showing an increase to the overall index as well as most component indices.

Today, the National Association of Home Builders (NAHB) released their latest Housing Market Index (HMI) showing an increase to the overall index as well as most component indices.It’s important to recognize that although the series are seasonally adjusted, each series has generally shown notable strength or noticeable flattening during the first quarter of each of the last 4 years.

The new home market will likely not resume any significant form of healthy function until the considerable overhang of inventory is cleared.

Each component of the NAHB housing market index remains WELL BELOW the worst levels ever seen in the over 20 years and continues to remain firmly in uncharted territory.

Tuesday, November 18, 2008

Homebuilder Blues: NAHB/Wells Fargo Home Builder Ratings November 2008

Today, the National Association of Home Builders (NAHB) released their latest Housing Market Index (HMI) showing dramatic new lows and continued evidence that the new home market is experiencing a prolonged bout of depression.

Today, the National Association of Home Builders (NAHB) released their latest Housing Market Index (HMI) showing dramatic new lows and continued evidence that the new home market is experiencing a prolonged bout of depression.Each component of the NAHB housing market index remain WELL BELOW the worst levels ever seen in the over 20 years the data has been being compiled strongly suggesting that the current severe contraction has surpassed all other events seen in the last 22 years and is now firmly in uncharted territory.

Thursday, October 16, 2008

Homebuilder Blues: NAHB/Wells Fargo Home Builder Ratings October 2008

Today, the National Association of Home Builders (NAHB) released their latest Housing Market Index (HMI) showing dramatic new lows and continued evidence that the new home market is experiencing a prolonged bout of depression.

Today, the National Association of Home Builders (NAHB) released their latest Housing Market Index (HMI) showing dramatic new lows and continued evidence that the new home market is experiencing a prolonged bout of depression.Each component of the NAHB housing market index remain WELL BELOW the worst levels ever seen in the over 20 years the data has been being compiled strongly suggesting that the current severe contraction has surpassed all other events seen in the last 22 years and is now firmly in uncharted territory.

Wednesday, October 17, 2007

New Residential Construction Report: September 2007

Today’s New Residential Construction Report firmly indicates a new leg down in the decline to the nation’s housing markets and for residential construction showing substantial declines on a year-over-year and month-to-month basis to single family permits both nationally and across every region.

Today’s New Residential Construction Report firmly indicates a new leg down in the decline to the nation’s housing markets and for residential construction showing substantial declines on a year-over-year and month-to-month basis to single family permits both nationally and across every region.Single family housing permits, the reports most leading of indicators, again suggests extensive weakness in future construction activity dropping 28.6% nationally as compared to September 2006.

Moreover, every region showed high double digit declines to permits with the West declining 34.6%, the South declining 30.4%, the Midwest declining 19.3% and the Northeast declining 16.0%.

Keep in mind that these declines are coming on the back of last year’s record declines.

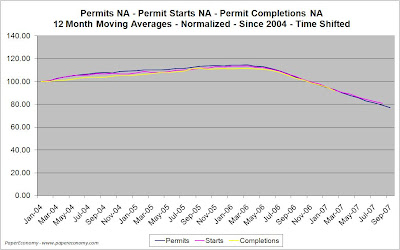

To illustrate the extent to which permits and starts have declined, I have created the following charts (click for larger versions) that show the percentage changes of the current values compared to the peak years of 2004 and 2005.

Notice that on each chart the line is essentially combining the year-over-year changes seen in 2005 and 2006 and shows virtually every measure trending down precipitously.

Although year-over-year declines to permits, for example, have not accelerated measurably from September 2006, the fact that they continue to decline roughly 20%-30% should provide a solid indication that they are by no means stabilizing.

Remember that permits, starts, and completions are not simply independent measures but are, in fact, three logically related and dependent measures.

Remember that permits, starts, and completions are not simply independent measures but are, in fact, three logically related and dependent measures.In the process of a building project, first you get the “permit”, next you “start” building, and finally you “complete” the project.

For this reason, one must adjust expectations prior to reading a newly released Census Department report to account for the true nature of the data published simultaneously each month.

As in past months, I have “smoothed” out the unadjusted data and aligned the three data series (i.e. moved starts ahead a month and completions ahead six months) to make more obvious their trend.

Here are the statistics outlined in today’s report:

Housing Permits

Nationally

- Single family housing permits down 28.6% as compared to September 2006

- For the Northeast, single family housing down 16.0% as compared to September 2006.

- For the West, single family housing permits down 34.6% as compared to September 2006.

- For the Midwest, single family housing permits down 19.3% as compared to September 2006.

- For the South, single family housing permits down 30.4% compared to September 2006.

Nationally

- Single family housing starts down 30.8% as compared to September 2006.

- For the Northeast, single family housing starts down 20.0% as compared to September 2006.

- For the West, single family housing starts down 32.2% as compared to September 2006.

- For the Midwest, single family housing starts down 28.8% as compared to September 2006.

- For the South, single family housing starts down 32.4% as compared to September 2006.

Nationally

- Single family housing completions down 30.8% as compared to September 2006.

- For the Northeast, single family housing completions down 20.0% as compared to September 2006.

- For the West, single family housing completions down 32.2% as compared to September 2006.

- For the Midwest, single family housing completions down 28.0% as compared to September 2006.

- For the South, single family housing completions down 32.4% as compared to September 2006.

Friday, October 05, 2007

The Daily 2¢ - Put On A Happy Face!

“Gray skies are gonna clear up,

Put on a happy face;

Brush off the clouds and cheer up,

Put on a happy face.

Take off the gloomy mask of tragedy,

It's not your style;

You'll look so good that you'll be glad

Ya' decide to smile!

Pick out a pleasant outlook,

Stick out that noble chin;

Wipe off that "full of doubt" look,

Slap on a happy grin!

And spread sunshine all over the place,

Just put on a happy face!”

Put on a happy face;

Brush off the clouds and cheer up,

Put on a happy face.

Take off the gloomy mask of tragedy,

It's not your style;

You'll look so good that you'll be glad

Ya' decide to smile!

Pick out a pleasant outlook,

Stick out that noble chin;

Wipe off that "full of doubt" look,

Slap on a happy grin!

And spread sunshine all over the place,

Just put on a happy face!”

So I guess it’s safe to say we are out of the woods!

No more subprime mortgage woes… no more credit concerns, Job growth is back to top form… The Fed’s mojo is really working its magic!

Of course, the housing data is falling into an abyss as is indicated by the last two pending home sales results as well as a surge in inventory and foreclosure data… but pay no attention!… that of little concern.

Today, let’s just smile.

Seriously now, it is very interesting how the general sentiment of our economic circumstances seem to progress in waves oscillating between the possibility of horrendous economic collapse and exuberant speculation.

There doesn’t seem to be much room in the middle.

I suppose that this is normal, or at least how our markets and our economy have been functioning for a long while but still, you wonder whether that’s not an indication of trouble in and of itself.

After witnessing the many thousands of predictions and outlook and actions that resulted from the churn that started in early August, I think it’s safe to say that even “dyed in the wool” Bulls are now having a hard time ignoring the obvious fundamental effects being brought on by the housing decline.

Still though, these same Bulls and many others persist, latching on to small bits of positive information like life rafts, effectively postponing any conscious acceptance of the inevitable.

There are clearly periods where the sentiment has shifted dramatically.

Like for example this time last year when Greenspan issued his initial “the worst may well be over” outlook and the Gates Foundation took up a widely publicized and substantial position in homebuilder stocks.

Wall Street seemed relieved and the homebuilders surged strongly, some moving up over 40% from their lows.

Of course, that time was brief.

The Gates Foundation sold off all their positions in December (unbeknownst to the rest of the investment community… funny how that happens) and by early February of this year when again it was reaffirmed that the unwinding of the great housing-mortgage mania was truly substantial and that the slowdown we had witnessed to that date was a mere opening act in a much larger production, real estate related stocks retreated, setting new lows.

So what should we make of the current euphoria?

Thursday, August 23, 2007

The Boogie Continues with Bob Toll

Yesterday, Toll Brothers (NYSE:TOL) reported Q3 earnings results confirming an additional $147.3 million of pretax write-downs that helped to depress their net income by an astounding 84.82% as compared to Q3 2006.

Also, it's important to note that the company has now announced a total of $363.9 million in pretax write-downs thus far in 2007 in a year that, in December of 2006, they had anticipated at most $60 million.

During the conference call, CEO Bob Toll appeared to offer very little optimistic sentiment pointing out that “horrible” buyer traffic is and setting new lows, handily surpassing the lows of prior downturns.

Additionally, Doug “The Bear” Kass of Seebreze Partners Management, Inc. makes an interesting appearance toward the end of the call.

The following are excerpts from yesterday’s conference call:

When asked about his “F- -“ rating for the Las Vegas housing market Toll replied:

“You might add another minus to that… What does it mean? It means you’ve flunked and what are we doing about it? We’re out there with the rest of the builders in Vegas praying. There’s not much you can do… You can’t advertise your way out of that situation. You just have to wait for a market to come back.”

Then referring to the results of the entire operations in Las Vegas, Toll reported:

“This week we took no deposits… we did take one agreement. Last week we took five deposits… the week before that we took none. The week before that we took six… The preceding four weeks before that we took twelve. These are deposits… I would guess about two thirds go to agreement. Then some of the agreements don’t stick. In the last eight weeks we’ve taken seven agreements. So, that’s what we consider real bad.”

When asked about whether buyer traffic was down in August as the mortgage-credit meltdown issue heated up Toll responded:

“Very simply, traffic is horrible. This past week was the lowest traffic for this particular week ever in our history. And that condition has existed, pretty much, for the last nine weeks. And then prior to that, there was a little hiatus where we did a little better that the worst in our history… then going back a little further, once again we are doing the worst in our history. So, our history includes ’87, ’88, ’89, ’90 so traffic is pretty stinky out there. ”

The final “piece de resistance” of the conference call was delivered by none other than Doug “The Bear” Kass of Seabreeze Partners Management, Inc.

Kass asked “This is a much broader question than has been asked on the conference call…(Toll: It’s great to be a short by the way… Kass: chuckles…) If the administration came to you to resolve the housing crisis, what remedies would you recommend Bob to bring supply and demand back into balance over a reasonable period of time?”

“Well, I think the most important thing is to immediately address the mortgage concerns. Giuliani was asked in an interview with Kudlow recently… would he bring in any regulation and he said that it was up to the market to straighten things out and it will. In my opinion, that’s probably what the guys said in ’29 that were running the Fed.

I was castigated recently for suggesting a few weeks ago that some government regulation would not be a bad thing. The average reaction was, the minute you let the government in, you’re begging for disaster. I can generally agree with that, look at whats happened with wetland regulations for instance… you need a team of lawyers to fill a puddle in your back yard.

On the other hand, where would we be without anti-trust legislation? We would probably have one oil company known as the United States of American Standard…. (chuckles about the slipup… American standard is a toilet manufacturer Toll was referring to Standard Oil)

I think a little regulation wouldn’t be a bad thing. I wouldn’t rule out 100% or 90% LTV but if you’re seeking that kind of thing, you have to pledge additional assets or at least prove additional assets so that so if the home price goes down and you want to walk, the mortgage lender has got a note that he can apply not only to the home but that he can apply to other assets that are obviously sufficient to take care of the loss.

What happened was, for a hundred years we had S&L’s as the backbone of the mortgage system and then they went bad and we tossed the baby out with the bathwater. And went to another system, that I don’t suggest that we try to break away from which is the securitization.

The problem is, everybody is working on commission today, nobody is a portfolio lender.

The guy that wants to get you the mortgage is a commission fella, and he’s handing it over to guys that are working commission to package it. The brokers are working on commission in order to sell the goods. And the guys buying the goods are not really paying attention to what they’re buying. And I think it’s reasonable to have standards imposed that you can’t lend above these lines and that should, to some extent, protect us from ourselves.

But I’m getting so many ‘cut the throats’ around here… guys are signaling to me to please stop this… and remember this is a Toll Brothers call and not a Bob Toll call so I’m off, I’m going back to Toll Brothers.”

Listen to the complete Q3 conference call here.

Here are some of the interesting data points from the Q3 release:

Third Quarter Results:

- Net income was $26.5 million down 84.82% compared to Q3 2006.

- Pre-tax land write-downs totaled $147.3 million up 516.31% compared to Q3 2006.

- Earnings per share declined 85.04% as compared to Q3 2006.

- Total revenues were $1.21 billion down 20.91% compared to Q3 2006.

- Net signed contracts were $727 million down 30.76% compared to Q3 2006.

- Quarter end backlog was $3.67 billion down 34.34% compared to Q3 2006.

- Signed contracts (after cancellations) was 1110 down 23% compared to Q3 2006.

CANCELLED!... Your now on your own.

Wednesday, June 13, 2007

Homebuilder Hoedown!

Yesterday JP Morgan held their Basics and Industrials Conference bringing together, amongst others, a host of top homebuilding executives to present their outlook for the new home business going forward.

Many homebuilders shared some particularly revealing insights in an effort to set the record straight on issues ranging from the subprime meltdown to DR Horton CEO Donald Tomnitz’s use of the word “suck”.

During the Hovnanian presentation, CEO Ara Hovnanian talked at length about current and future land purchasing as well as his take on raising interest rates.

When asked about their prospects for new land purchases, Hovnanian answered:

“I can tell you our new land purchases are down to a trickle right now, we had been looking and the reality is again, we’ve seen every cycle, the land sellers are always the last to recognize the housing slowdown and hat typically has happened is that housing prices have come down first, and the land prices ultimately come down but they’re always trailing. While prices come down and terms come down, they never come down to equal housing prices till much later in the down-cycle.

When we do new land purchases, we have to make our threshold returns at current net-net prices after all incentives and concessions and net-net absorptions after all cancellations. Today, we’re finding very very few land parcels that meet that criteria and frankly, with the market in transition and without being very stable and now with our greater focus on cash flow, I can’t say we’re anxious to go out and buy some land right now.

We have probably gone from 20,000 (properties) to less then 1,000 that we have purchased in the last six months so it’s dropped dramatically and I don’t see that changing over the next six months.”

When asked at what point mortgage rates would begin to effect buyer ability to purchase new homes, Hovnanian responded:

“It’s hard to predict that, I can just say this, prices of homes have corrected dramatically that makes all housing a lot more affordable without a doubt. The lower the mortgage rates, obviously, the more helpful it is. Psychologically, I used to say over 8% was probably the point where it starts to become more harmful, today if long rates go over 7% I just think psychologically it may be more of a barrier but we’re a ways from that right now. I think we’ve got lots of things to worry about in the homebuilding business, personally I don’t think mortgage rates are high on my radar screen of big concerns. I just think that there are other risks or factors that we’re more concerned about than interest rates.”

Listen to the entire Hovnanian presentation here.

During the Toll Brothers presentation, Fred Cooper, Senior Vice President of finance and investor relations was asked about the outlook for impairment charges resulting from land write-downs for which he responded:

“In total we’ve had about $360 million in write-downs over the last three quarters, about $250 million of it has been on owned land and then $110 million on optioned land. Generally I think more of the write-downs have come on land that is less mature where they were put under option based on stronger market assumptions. … Most of the write-downs are on land that is relatively newer and we can’t really predict what the next couple of quarters will bring in terms of write-downs but if the market, in a particular community weakens, that could tip it over the edge. It’s very hard to predict and when we gave our guidance for 2007 recently on our call we said that we’re not able to predict future write-downs at the moment.”

Listen to the entire Toll Brothers presentation here.

During the DR Horton presentation, CEO Donald J. Tomnitz provided, as usual, many candid tidbits.

Discussing the fact that DR Horton had the lowest impairments for the industry, Tommnitz stated:

“I know we have been criticized by many for not having as many impairments, it’s amazing to even get criticized for, I think, operating perhaps a better company than other. But let me tell you a couple of reasons why I think we have had fewer impairments at least then others. One is, clearly I think we are more astute land buyers. Ok, you can look at that and say “Punk, you can’t prove that” well as we move through the market we’ll find out whether I’m right or wrong. I think the second part of that is that we have never done any JVs, we have inherited JVs so as a result we have always had a policy in our company of not doing deals that are too large for us. If we had a deal that was too large, we would pass. And many of the impairments are coming from deals that people did that were too big at the time.”

When asked about the effects of the subprime meltdown, Tommitz stated:

“I believe I’m correct in saying, when I was out in Phoenix last week, FHA is in the process of, in the next 60 days you’ll see them implement some new mortgages which basically are going to include 100% loans. I have no idea why they are going there but they’re going to include 100% loans. And as a percentage overall, if you talk to all of our division presidents, the subprime, alt-a scenario has been totally overblown by the media and we don’t believe its had a significant impact on our business.

What has had a significant impact on our business and what I think it’s going to take to get the homebuilding business back clearly on its feet is that we still have excess inventory on the marketplace. We have too many homes under construction that are unsold. I think all the builders are doing a great job in terms of starting fewer homes because that’s what we need to do.”

“I was in Phoenix, the level of existing homes that have been historically on the market in Phoenix has been about 25,000 right now in Phoenix it sits around 52,000. In Las Vegas it’s supposed to be about 20,000 it sits today at about 40,000. But we’re not receiving as much direct competition, as all of you would like to believe, from existing home buyers. And why? Because the investors bought homes from us. And they typically bought them at 100% financing. So, they bought a home from us at $270,000 that same home today we may be selling for $250,000. So, there are going to have to do one of two things. They’re either going to have to keep that home and rent it for the next two to three years till the prices come back up to $270,000 or they’re going to have to sell the home for $250,000 which is what we’re selling the home for today. I don’t know about you, but you can to Mr. and Mrs. America and there aren’t many people who can take that $270,000 and sell it for $250,000 and take a $20,000 check from their bank to the title company and close the transaction. So those existing homes are going to be leased because almost all of them have 100% financing on them or a lot of them do, especially the investor loans, so we’re not really competing with that inventory.”

Later Tomnitz talked a bit about his now infamous “Suck” comment.

“One of the reasons I don’t want to interview with CNBC is that they made a big deal out of a word that, after four years in the Army, raising two teenagers, riding Harley’s and being in the homebuilding business for a number of years I had no idea the word “Suck” was a cuss word (laughter) but for any of you ah… if that bothered you and I insulted you I apologize but it just didn’t occur to me. … What I wanted to say was that the homebuilding business is going to suck for the homebuilders in 2007, but it’s going to be a windfall for the homebuyers.”

Listen to the entire DR Horton presentation here.

Monday, May 28, 2007

Gettin’ Down with Toll

Toll Brothers (NYSE:TOL) reported Q2 earnings results last week confirming a $119.7 million of pretax write-downs that served to depress their net income by an astounding 79% as compared to Q2 2006.

Toll Brothers (NYSE:TOL) reported Q2 earnings results last week confirming a $119.7 million of pretax write-downs that served to depress their net income by an astounding 79% as compared to Q2 2006.Additionally, Toll yet again reduced its expectation for the maximum number of homes delivered for 2007 from 7300 homes last December to 7000 in Q1 now to 6900.

During the conference call, CEO Bob Toll uncharacteristically offered very little optimistic sentiment even offering some skepticism regarding recent Treasury Secretary Paulson’s “market bottom” outlook and the recent up-tick in the Census Department’s New Home Sales.

“I think what that indicates is that most new homebuilders that are large, the public homebuilders, their average product goes anywhere from about $250K up to us which is about $700,000 so obviously the increase [in sales] is taking place below our space. Which means that we’re not out of the woods yet. I took with surprise yesterday and it’s now confirmed today by this analysis when the secretary of the treasury said that we’ve got the hard times pretty much behind us I wondered how many communities he had and where he got that information but I now understand that the information he got hadn’t been pealed away, I guess, to show that it was $150,000 housing. So I would say that we have not got the bad times behind us yet though it could be… you never know.”

When asked about the April year-over-year comparisons getting less negative Toll suggested that favorably comparing against a year that “stinks” is not what he’s looking for.

“As you get further in to a down market, in terms of length of time, the comparisons are going to get better. So that, ultimately, if we stay here for a long period of time, you will see that April sales equaled April sales last year. That’s not what we’re looking for of course. So, I think the statements are a little misleading. The comparisons are good but what you’re comparing to stinks so that’s why your getting unhappiness expressed by the public home builders.”

Ivy Zelman, analyst with Credit Suisse First Boston tweaked Bob Toll in a minor skirmish over Toll’s interest in buying additional land.

Toll: “I would hope that we would increase the land portfolio somewhat from where we are now, we are actively looking and trying to buy… We have raised thresholds because we can and I think we should operate more prudently, more carefully than we did when the market was going up.”

Ivy: “You don’t feel that having almost a 10 year supply of land is enough?”

Toll: “Well, we hope that it’s not 10 years Ivy.”

The complete conference call can be listened to here.

Here are some of the interesting data points from the Q2 release:

Second Quarter Results

- Net income was $36.7 million down 79.0% compared to Q2 2006.

- Pre-tax land write-downs totaled $119.7 million up 897.5% compared to Q2 2006.

- Earnings per share declined 66.7% as compared to Q2 2006.

- Total revenues were $1.17 billion down 18.75% compared to Q2 2006.

- Net signed contracts were $1.17 billion down 25% compared to Q2 2006.

- Quarter end backlog was $4.15 billion down 31.6% compared to Q2 2006.

- Signed contracts was 2031 down 14% compared to Q2 2006.

- Deliver 6100 – 6900 homes (prior estimate 6000 – 7000).

Thursday, May 10, 2007

Toll’s Dirty Dance

Ouch!

Ouch!Things have not gone well for Toll Brothers (NYSE:TOL), certainly not nearly as well as CEO Bob “Dancing on the Bottom” Toll had anticipated as 2006 drew to a close.

Back then, an optimistic Toll had suggested that the housing downturn may likely have bottomed.

“Fifteen months into the current slowdown, we may be seeing a floor in some markets where deposits and traffic, although erratic from week to week, seem to be dancing on the bottom or slightly above.”

Furthermore, at that time Toll Brothers announced that they budgeted an additional $60 million to account for all pretax write-downs for the entire year of 2007, an allotment easily surpassed by the $96.9 million actually required for only the first quarter of 2007.

Now, Toll has announced an additional $90 million to $130 million in pretax write-downs for just Q2 2007!

That brings the total of pretax write downs to somewhere between $186.9 million to $226.9 million for just the first half of 2007, a truly astounding number compared to the $152 million in write-downs taken in all of 2006.

As for the dancing, Toll now suggests that things have taken a turn for the worse.

“Virginia came back… remember when I had said, either last quarter or the quarter before that that we were dancing off the bottom.. or something opaque like that, in the northern Virginia, Maryland, Washington DC market. The market continued to improve, not much but a little bit, and [now] it’s back down a little bit.”

As for additional impairment write-downs soon to come from obviously poorly purchased property such as a very large parcel Toll purchased on the outskirts of Las Vegas in January 2006, Tool responded:

“The real answer is, you haven’t reached the point where can prove to your auditors that the value isn’t there and therefore has to be written down in order to show a profit. I mean, you could argue all day that Vegas is slow and this property is going to come on the market in 09 and if things are in 09 as they are today, when we open it, we’ll be hard pressed show a profit and they’ll want to get vary exact and say ‘hard pressed quite do it’. You’ve got to show that you’re below the line.”

When asked about his outlook for the housing market in Florida, Toll replied:

“Nice place to play golf in the winter, but not a great place to sell homes right now. There are probably great opportunistic land deals in Florida, the problem is, sometimes half-price ends up to be twice-price.”

When asked if he thought there would likely be additional future reductions of “head-count” (layoffs) Toll responded:

“I prefer to call it overhead, and the answer is yes. We haven’t stopped, but we will be looking even more seriously at reducing overheads where sales paces are reduced.”

When asked to “grade” the different markets across the nation, Toll responded:

“In our northern territories, Massachusetts and Rhode Island are ‘F’. Connecticut is a ‘B+’. New York exurbs are ‘B+’, New York urban which for us is Queens, Brooklyn and Manhattan are a ‘B+’ if not an ‘A’. Jersey City and Hoboken are a ‘B+’. New Jersey suburbs, oddly enough when you juxtapose them against the New York suburbs ... you got an ‘F’, it may be due to the tax situation in New Jersey, Michigan is an ‘F’. Chicago is surprisingly still and ‘F’ market. Minnesota is a ‘C-‘ market which is a whole lot better than it was. The Philadelphia suburbs is a ‘B’ market for us. The Poconos is an ‘F’ market. The state of Delaware is a ‘C+’ market. The mid-Maryland shore, as I said earlier, is an ‘F’ market. Washington DC, northern Virginia is probably a ‘D+’ market. Raleigh is a ‘B’ market. Charlotte is a ‘B’ market. South Carolina is a ‘D’ market as in dog. Florida, central market, Orlando, we sell a lot of homes, we get the same homes back, we sell the same homes, we get the same homes back, it’s a very hard market to figure. People, I guess are renting them without ever moving in. That’s and ‘F’ market. Florida east coast is an ‘F+’ market. Florida north, Jacksonville, pretty much an ‘F+’ market. Tampa is an ‘F’. Florida on the west coast is an ‘F’. Texas is good, Austin is a ‘B’ market, Dallas and San Antonio, we’ve got a ‘C’ market because we haven’t got our product up and running as we should yet so it’s only a ‘C’ market. I suspect it’s really a ‘B’. Northern California averages to be a ‘C’ market for us, there are some pockets that are ‘B’ and some that are ‘D’. California southern market is a ‘C’ market for us. California Palm Springs is a ‘C’ market for us. Arizona … I would rate as a ‘D-‘. Vegas is definitely an ‘F’. Reno is an ‘F’. Colorado is a ‘C’.”

During the conference call, there is extensive discussion on Toll Brothers outlook for impairments as well as their methodology and criteria used to determine and take them which can be listened to in its entirety here.

Here are some of the interesting data points from today’s preliminary release:

- Total revenue totaled $1.17 billion, down 19% as compared to Q2 2006

- Quarter end backlog totaled $4.15 billion, down 32% as compared to Q2 2006

- Net signed contracts totaled $1.17 billion, down 25% as compared to Q2 2006

- Pre-tax land write-downs totaled between $90 million and $130 million

- Q2 cancellations totaled 384 compared to 436 in Q1 2007

housing+bubble housing bubble realtor sub-prime subprime home+builder homebuilder bob+toll toll+brothers economy recession interst+rates mortgage

Copyright © 2007

PaperMoney Blog - www.paperdinero.com

All Rights Reserved

Disclaimer

Copyright © 2007

PaperMoney Blog - www.paperdinero.com

All Rights Reserved

Disclaimer

Tuesday, April 17, 2007

New Residential Construction Report: March 2007

Popularly reported as an “unexpected rise” in housing starts, today’s New Residential Construction Report continues to indicate significant weakness in the nations housing markets and for residential construction.

Popularly reported as an “unexpected rise” in housing starts, today’s New Residential Construction Report continues to indicate significant weakness in the nations housing markets and for residential construction.In particular, housing permits, the report most leading of indicators, again indicates substantial weakness in future construction activity both nationally and across every reported region.

As predicted, housing completions are now declining significantly on a year-over-year basis indicating that the contraction in construction activity may soon be reflected by a substantial drop-off in construction related jobs as older projects reach completion and newer projects start at a far slower pace.

Now, we are well within the period in which permits and starts began to show significant weakness last year so the current double-digit year-over-year declines to those measures unequivocally indicate that the housing market has not yet stabilized.

Here are the statistics outlined in today’s report:

Housing Permits

Nationally

- Single family housing permits up 1.4% from February, down 28.4% as compared to March 2006

- For the Northeast, single family housing up 1.3% from February, down 35.7% as compared to March 2006.

- For the West, single family housing permits up 2.1% from February, down 22.7% as compared to March 2006.

- For the Midwest, single family housing permits up 19.5% from February, down 29.1% as compared to March 2006.

- For the South, single family housing permits down 3.6% from February, down 29.6% compared to March 2006.

Nationally

- Single family housing starts up 2.0% from February, down 24.6% as compared to March 2006.

- For the Northeast, single family housing starts down 7.8% from February, down 35.2% as compared to March 2006.

- For the West, single family housing starts down 5.9% from February, down 26.7% as compared to March 2006.

- For the Midwest, single family housing starts up 35.9% from February, down 17.2% as compared to March 2006.

- For the South, single family housing starts down 0.5% from February, down 24.1% as compared to March 2006.

Nationally

- Single family housing completions up 1.5% from February, down 28.9% as compared to March 2006.

- For the Northeast, single family housing completions down 16.2% from February, down 35.8% as compared to March 2006.

- For the West, single family housing completions up 17.8% from February, down 28.3% as compared to March 2006.

- For the Midwest, single family housing completions up 7.6% from February, down 36.0% as compared to March 2006.

- For the South, single family housing completions down 3.8% from February, down 25.9% as compared to March 2006.

housing+bubble real+estate new+construction housing+starts housing realtor permits home+sales cancellations residential decline MarketWatch

Copyright © 2007

PaperMoney Blog - www.paperdinero.com

All Rights Reserved

Disclaimer

Copyright © 2007

PaperMoney Blog - www.paperdinero.com

All Rights Reserved

Disclaimer

Tuesday, March 20, 2007

New Residential Construction Report: February 2007

Popularly reported as showing a “bounce back” to housing starts, today’s New Residential Construction Report continues to indicate significant weakness in the nations housing markets and for residential construction.

Popularly reported as showing a “bounce back” to housing starts, today’s New Residential Construction Report continues to indicate significant weakness in the nations housing markets and for residential construction.Although it’s a widely held belief that the best selling season is the spring, leading some to look for signs of strength later the year, it may be that this report is showing us the best numbers we are going to see for residential construction in 2007.

As Bob Toll recently recounted, the period between January and Presidents day weekend is considered the “hot” selling season in the new home market and by his account this year was a “bust”.

“Well the Spring selling season is over, it’s a misunderstanding that we have been unable to correct over the past 40 years. In the new home business, you start selling immediately after the holidays.. it increases in number and then there’s a pretty substantial jump right after the Super Bowl because ‘she’ hasn’t been able to get ‘him’ out of the seat to go and see the product on Sunday, which is our big day, then you continue to run-up from after the Super Bowl to Presidents Day weekend… That’s the peak of the market… We have had this substantial jump from the December sales into January, we had this substantial jump from January into February but that jump cam no where near on a per-community basis to what it’s been on an average over the past 10 years.”

Today’s report shows permits and starts down high double-digits both nationally and in every region with completions now accelerating to the downside as had been widely speculated.

In fact, the report shows that completions from January as well as on a year-over-year basis are now declining in every region with particularly steep declines as compared to February 2006.

Further significant declines from here on out would unequivocally indicate that the housing market has not yet stabilized.

Here are the statistics outlined in today’s report:

Housing Permits

Nationally

- Single family housing permits down 3.1% from January, down 32.9% as compared to February 2006

- For the Northeast, single family housing down 23.8% from January, down 38.9% as compared to February 2006.

- For the West, single family housing permits up 4% from January, down 30.0% as compared to February 2006.

- For the Midwest, single family housing permits down 16.9% from January, down 43.2% as compared to February 2006.

- For the South, single family housing permits up 1.4% from January, down 30.3% compared to February 2006.

Nationally

- Single family housing starts up 10.3% from January, down 32.7% as compared to February 2006.

- For the Northeast, single family housing starts down 26.0% from January, down 37.2% as compared to February 2006.

- For the West, single family housing starts up 37.4% from January, down 35.9% as compared to February 2006.

- For the Midwest, single family housing starts down 19.3% from January, down 52.3% as compared to February 2006.

- For the South, single family housing starts up 16.4% from January, down 23.5% as compared to February 2006.

Nationally

- Single family housing completions down 11.3% from January, down 23.1% as compared to February 2006.

- For the Northeast, single family housing completions down 24.1% from January, down 16.4% as compared to February 2006.

- For the West, single family housing completions down 10.9% from January, down 38.0% as compared to February 2006.

- For the Midwest, single family housing completions down 20.4% from January, down 36.4% as compared to February 2006.

- For the South, single family housing completions down 6.6% from January, down 11.5% as compared to February 2006.

housing+bubble real+estate new+construction housing+starts housing realtor permits home+sales cancellations residential decline MarketWatch

Copyright © 2007

PaperMoney Blog - www.paperdinero.com

All Rights Reserved

Disclaimer

Copyright © 2007

PaperMoney Blog - www.paperdinero.com

All Rights Reserved

Disclaimer

Friday, March 16, 2007

Dancing with Toll

Yesterday, Toll Brothers executives were out in force, stumping simultaneously at two separate investor conferences.

Yesterday, Toll Brothers executives were out in force, stumping simultaneously at two separate investor conferences.First, there was the UBS US Home Building and Building Products Conference which featured several panels of home builder and product COOs and CFOs speaking about their respective companies as well as the outlook for the housing market.

In somewhat of a reversal of prior statements made by Bob Toll, Fred Cooper, Senior Vice President of Toll Brothers suggested the following regarding the effect of the sub-prime mortgage market had on housing demand:

“In 2004 2005 suddenly you had a ratcheting up of demand … so you had home price increases that were very rapid. As it turns out, in retrospect, a bunch of that home price increases were being fueled by speculators and I expect when the dust settles its going to turn out that a lot of the speculators were being fueled by the sub-prime mortgage market because they would be able to control five or six homes at a time without having to put up much capital.”

When asked about the credit quality of Toll Brothers buyers, Copper responded:

“Our buyers typically borrow just a little bit North of 70% of the purchase price of their homes so they’re not really overstretching. I would say 1% to 2% of our buyers use sub-prime and they generally use it for a bridge.. so it really wasn’t a big factor in our buyers buying ability. ”

Formally, Bob Toll made statements downplaying the effects that sub-prime mortgage lending had on their sales, suggesting that Toll Brothers buyers generally aren’t sub-prime buyers although he did note that there were quite a few investors buying Toll Brothers homes during the housing run-up.

Possibly the reality is somewhere in the middle whereby those who bought Toll Brothers homes for their primary residence generally used prime or Alt-A funding but speculating investors used sub-prime loans as Cooper suggested.

Cooper later makes the following statements:

“To say that we were wrong in 2004 2005… I don’t think we were wrong, we went from $400 million in profits to $800 million in profits and I don’t think that we would have wanted to forego those… Well I think what we missed was, I think we misjudged how impactful the speculators were.”

Listen to the entire presentation and Q&A here with Fred Cooper here.

Simultaneously, Robert Toll, CEO of Toll Brothers addressed Citigroup's Small & Mid-Cap Conference where stated that “housing is in a considerable slump”.

“Housing is a market of sub-markets and really shouldn’t be spoken about in general. Some markets are knocking them dead right now but their few and far between. Most of the markets are having a difficult time. The primary reason is the oversupply left by speculators and investors who got caught up in the mania of the price increases that were brought to the market by the extra demand created by the speculators and investors.”

Toll then goes on to play out a strange fictional scenario to demonstrate that in some markets, Toll is actually attempting to prove to buyers, with a little tough love, that there really is more demand than they think.

“somebody will come to the office and say ‘Ill take it but I need $10,000 more in incentives’… we’ll say ‘no’ and they’ll say ‘well I’m very sorry’ and they leave. Then they come back next week.. ‘how we doing…’ and we say ‘well I’m very sorry we’re doing well but we’ve had a two thousand dollar price increase and we are still maintaining the same incentives’ but we have posted a price increase because we want to show the market that we have more demand than the market believes we have and then that person will buy.”

Later, when asked to elaborate on these selective price increases during this spring selling season Toll offered this telling analysis:

“Well the Spring selling season is over, it’s a misunderstanding that we have been unable to correct over the past 40 years. In the new home business, you start selling immediately after the holidays.. it increases in number and then there’s a pretty substantial jump right after the Super Bowl because ‘she’ hasn’t been able to get ‘him’ out of the seat to go and see the product on Sunday, which is our big day, then you continue to run-up from after the Super Bowl to Presidents Day weekend… That’s the peak of the market… We have had this substantial jump from the December sales into January, we had this substantial jump from January into February but that jump cam no where near on a per-community basis to what it’s been on an average over the past 10 years.”

“As a matter of fact, it was probably as bad in traffic as a half, which is terribly down, now this is on average… the Spring selling season, or the prime selling season is pretty much a bust on a per-community basis.”

“When you stepped back and looked at it [it was] no where near where it should have been if you were looking at an average of the last 10 years.”

Then Toll goes on at length about speculators and the sub-prime market:

“By the way, speculative investors have not left the market entirely. There are still speculator investors that are now circling the market as the buzzards would on the carcass because prices have gone so far down on standing inventory that investor speculators are doing anything they can to try and get an additional incentive on that property and to buy it with as little as possible which was made possible by the idiocy of the sub-prime market until very recently. But it’s not done yet.”

“Sub-prime originators will struggle to continue to deliver sub-prime product because if they can’t they’re out of business, and before they go out of business they are just going to continue as hard as they can to be able to produce no-doc loans 100% financing… speculators eat this up.”

In a funny conclusion, Toll delivers another dancing anecdote:

“I remember in 1974 literally having to dance on top of the desk of the Third Federal CEO Mr. Greenberg who said if I got up and danced on his desk he would give me three mortgages so that I could take them and sell homes. Those were tough times… We may get there… I hope we don’t but we’re certainly not there right now.”

Listen to the entire presentation and Q&A here with Bob Toll here.

housing+bubble housing bubble realtor sub-prime subprime home+builder homebuilder bob+toll toll+brothers economy recession interst+rates mortgage

Copyright © 2007

PaperMoney Blog - www.paperdinero.com

All Rights Reserved

Disclaimer

Copyright © 2007

PaperMoney Blog - www.paperdinero.com

All Rights Reserved

Disclaimer

Subscribe to:

Posts (Atom)