Today, the National Association of Realtors (NAR) released their Pending Home Sales Report for November 2007 showing a truly stark and even worsening continuation of the historic decline to residential housing on a year-over-year basis, both nationally and in every region.

Today, the National Association of Realtors (NAR) released their Pending Home Sales Report for November 2007 showing a truly stark and even worsening continuation of the historic decline to residential housing on a year-over-year basis, both nationally and in every region.Continuing down the second slope of the pullback in demand for residential housing, ALL regions are now tracking at or below the lowest values ever recorded with the Northeast now registering nearly 30% fewer sales than in 2001, the first year Pending Home Sales were tracked.

As usual, NAR Senior Economist Laurence Yun makes another attempt at self interested spin and false optimism suggesting that today there are more potential home buyers but that many are simply sitting on the sidelines waiting to pounce on the market in the coming spring market.

“There are more people with financial capacity now than in 2005, but many are trying to market-time their purchase. As a result, the exact timing and the strength of a home sales recovery is a bit uncertain. A meaningful recovery in existing-home sales could occur as early as this spring, or it may be further delayed toward late 2008.”

Too bad Yun forgets to mention that the potential borrowing power of all buyers has declined significantly as the ongoing unwinding of the mortgage-credit bubble has resulted in significantly tighter lending standards and the outright absence of Jumbo loans.

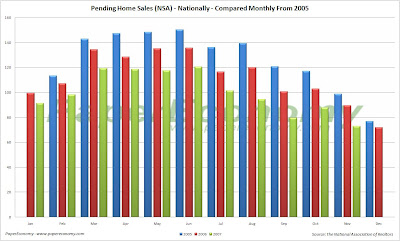

The following chart shows the national Pending Homes Sales Index since 2005 compared monthly. Notice that each year, the months value is decreasing consistently (click for larger version).

The following chart shows the year-over-year changes to the national Pending Home Sales index as well as comparing the latest results against the values seen in the peak year of 2005 (click for larger version).

The following chart shows the year-over-year changes to the national Pending Home Sales index as well as comparing the latest results against the values seen in the peak year of 2005 (click for larger version). Note that in the above charts, I had to use the Not Seasonally Adjusted (NSA) data series as NAR changed the methodology for their Seasonally Adjusted (SA) series a while back and never republished the numbers. This is why none of the data appears to be breaking below a value of 100 because it’s the SA series that is now below 100.

Note that in the above charts, I had to use the Not Seasonally Adjusted (NSA) data series as NAR changed the methodology for their Seasonally Adjusted (SA) series a while back and never republished the numbers. This is why none of the data appears to be breaking below a value of 100 because it’s the SA series that is now below 100.Keep in mind the current pending sales decline comes ON TOP of last years historic fall-off so the continued weakness is a sure sign that the decline is not ephemeral.

Look at the November seasonally adjusted pending home sales results and draw your own conclusion:

- Nationally the index was down 19.2% as compared to November 2006.

- The Northeast region was down 19.1% as compared to November 2006.

- The West region was down 18.5% as compared to November 2006.

- The Midwest region was down 18.6% as compared to November 2006.

- The South region was down 19.8% as compared to November 2006.