With the federal bailout now well underway and seeing that the battered massive “linchpin” mortgage enterprises of Fannie Mae (NYSE:FNM) and Freddie Mac (NYSE:FRE) will, with the help of the “temporary” increase of the conforming loan limits, the brazen lowering of their capital requirements and other even more novel actions, ride to the rescue of the nation’s housing markets!

With the federal bailout now well underway and seeing that the battered massive “linchpin” mortgage enterprises of Fannie Mae (NYSE:FNM) and Freddie Mac (NYSE:FRE) will, with the help of the “temporary” increase of the conforming loan limits, the brazen lowering of their capital requirements and other even more novel actions, ride to the rescue of the nation’s housing markets!But who will rescue them when the time comes?

I suppose you and me, our children and their children too…. It’s a real shame since these enterprises seemed to be doing so well recently, short of that stint in 2004 where Fannie Mae executives fleeced the company of over $100 million in fraudulent bonuses and the like…

Oh well, how’s another socialized bailout of private swindlers going hurt a country so deep in debt that dollar amounts on the order of billions just don’t seem to sting anymore… even trillions of dollars now seem a bit passé.

It’s important to note that all the recent changes are taking place with no required modifications to the GSEs operational practices and no additional powers granted to their Federal regulator the Office of Federal Housing Enterprise Oversight (OFHEO).

Given the sheer size of these government sponsored companies, with loan guarantee obligations recently estimated by Federal Reserve Bank of St. Louis President William Poole of totaling $4.47 Trillion (That’s TRILLION with a capital T… for perspective ALL U.S. government debt held by the public totals roughly $4.87 Trillion) and the “fuzzy” interpretation of their “implied” overall Federal government guarantee should they experience systemic crisis, these changes are reckless to say the least.

One key to understanding the potential risk that these entities face as the nation’s housing markets continue to slide lies in considering their current lending practices.

Although it’s been widely assumed by many that Fannie Mae and Freddie Mac have utilized a more conservative and risk averse standard for their loan operations, it now appears that that assumption is weak.

Whether it’s their subprime loan production, low-no down payment “prime” lending practices, or their conforming loan-piggyback loophole, the GSEs participated as aggressively in the lending boom as any of the now infamous bankrupt or near-bankrupt mortgage lenders.

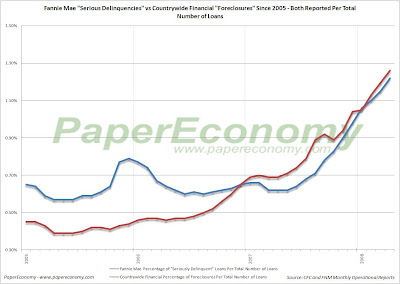

Additionally, it’s important to understand that Countrywide Financial has been and continues to be Fannie Mae’s largest lender customer and servicer responsible for 28% (up from 26% in FY 2006) of Fannies credit book of business.

To that end, let’s compare the performance of Fannie Mae’s operations with that of Countrywide Financial.

NOTE: Since Countrywide Financial has discontinued reporting their monthly operational status in February the data supplied below is based on a estimates generated by a simple linear extrapolation of the actual data supplied between 2005 – February 2008. I will update the data when and if Countrywide ever provides data on its internal state.

The following chart (click for larger) shows what Fannie Mae terms the count of “Seriously Delinquent” loans as a percentage of all loans on their books.

It’s important to understand that Fannie Mae does NOT segregate foreclosures from delinquent loans when reporting these numbers and that should they report the delinquent results as a percentage of the unpaid principle balance, things would likely look a lot worse.

In order to get a better sense of the relative performance of Fannie Mae as compared to Countrywide Financial, the following chart (click for larger) compares Fannie Mae’s “Seriously Delinquent” loans (which include foreclosures) to Countrywide

In order to get a better sense of the relative performance of Fannie Mae as compared to Countrywide Financial, the following chart (click for larger) compares Fannie Mae’s “Seriously Delinquent” loans (which include foreclosures) to CountrywideFinancials loans in foreclosure.

Finally, the following chart (click for larger) shows the relative movements of Fannie Mae’s credit and non-credit enhanced (insured and non-insured) “Seriously Delinquent” loans versus Countrywide Financials delinquencies as a percentage of total loans.

Finally, the following chart (click for larger) shows the relative movements of Fannie Mae’s credit and non-credit enhanced (insured and non-insured) “Seriously Delinquent” loans versus Countrywide Financials delinquencies as a percentage of total loans.