It’s important to remember that the CSI data is lagged by two months and that today’s results represent the trend of prices paid from home sales closed between October-December of 2009.

Now that the strongest selling months have been reported, look for all remaining CSI releases until early spring to continue to indicate notable price weakness coming from typical seasonal declines as well as extra-seasonal declines as a result of reduced demand from activity that was “stimulated” forward into the summer and early fall by the tax sham.

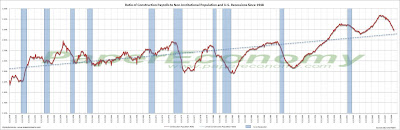

Also, looking at the 1990s-era comparison charts below its obvious that even after the main downward thrust has been reached, the housing markets have a long tough slog ahead with the ultimate bottom likely many years out…. Or if we are currently experiencing the Japanese model… decades out.

Further, is important to remember that the 90s housing recovery played out against the backdrop of a truly unique period of growth in the wider economy fueled primarily by novel and ubiquitous technological change (cell phones, internet, personal computers, telecommunications, etc).

Today, we may not be so lucky.

The 10-city composite index declined 2.41% as compared to December 2008 while the 20-city composite declined 3.08% over the same period.

Topping the list of regional peak decliners was Las Vegas at -55.54%, Phoenix at -50.52%, Miami at -47.07%, Detroit at -42.87% and Tampa at -41.67%.

Additionally, both of the broad composite indices show significant peak declines slumping -30.10% for the 10-city national index and -29.35% for the 20-city national index on a peak comparison basis.

To better visualize today’s results use Blytic.com and search for “case shiller”.

The following chart (click for larger version) shows the percent change to single family home prices given by the Case-Shiller Indices as compared to each metros respective price peak set between 2005 and 2007.

The following chart (click for larger version) shows the percent change to single family home prices given by the Case-Shiller Indices as on a year-over-year basis.

The following chart (click for larger version) shows the percent change to single family home prices given by the Case-Shiller Indices as on a year-over-year basis. The following chart (click for larger version) shows the percent change to single family home prices given by the Case-Shiller Indices as on a month-to-month basis.

The following chart (click for larger version) shows the percent change to single family home prices given by the Case-Shiller Indices as on a month-to-month basis. Additionally, in order to add some historical context to the perspective, I updated my “then and now” CSI charts that compare our current circumstances to the data seen during 90s housing decline.

Additionally, in order to add some historical context to the perspective, I updated my “then and now” CSI charts that compare our current circumstances to the data seen during 90s housing decline.To create the following annual charts I simply aligned the CSI data from the last month of positive year-over-year gains for both the current decline and the 90s housing bust and plotted the data with side-by-side columns (click for larger version).

What’s most interesting about this particular comparison is that it highlights both how young the current housing decline is and clearly shows that the latest bust has surpassed the prior bust in terms of intensity.

What’s most interesting about this particular comparison is that it highlights both how young the current housing decline is and clearly shows that the latest bust has surpassed the prior bust in terms of intensity. The “peak” chart compares the percentage change, comparing monthly CSI values to the peak value seen just prior to the first declining month all the way through the downturn and the full recovery of home prices.

The “peak” chart compares the percentage change, comparing monthly CSI values to the peak value seen just prior to the first declining month all the way through the downturn and the full recovery of home prices.

In this way, this chart captures ALL months of the downturn from the peak to trough to peak again.

In this way, this chart captures ALL months of the downturn from the peak to trough to peak again.As you can see the last downturn lasted 97 months (over 8 years) peak to peak including roughly 43 months of annual price declines during the heart of the downturn.