This week, housing should dominate the economic news if not for the fact that the slowdown is now firmly upon us and generally acknowledged by all, then, at least, for lack of inflation reports or Federal Reserve appearances.

This week, housing should dominate the economic news if not for the fact that the slowdown is now firmly upon us and generally acknowledged by all, then, at least, for lack of inflation reports or Federal Reserve appearances. Listening to CNBC, it’s pretty hard to miss the change in attitude. Nearly every other segment seems to be dominated by the specter of a housing led consumer recession.

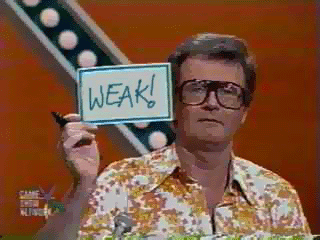

Remember, just about this time last year there was some fairly rigorous debate as to whether there was going to be a housing slowdown at all.

Now, with what seems to be a daily torrent of mounting evidence pointing to a further and even more substantial decline of the housing market, debate has shifted to how deep the downturn will go.

While most housing optimists still maintain that, nationally, the slowdown has been “orderly” and is heading for a “soft-landing”, a recent report by the National Association of Realtors showed that 28 states and the District of Columbia have shown declining sales with the most significant losers being Arizona, Florida, California, Virginia and Nevada.

Additionally, home builders have reported previously and are now reaffirming record numbers of cancellations, substantially fewer orders, declining revenues, and land write-downs, all contributing to pushing builder confidence down to a 15 year low.

Furthermore, Foreclosure rates have been on the rise across the nation, showing particularly striking increases in the country’s bubbliest areas.

Although this week’s fallout should come as no surprise, especially given that some results were pre-released, be on the lookout for housing to dominate the nation’s economic news.

This weeks notable housing events:

Tuesday

- Toll Brothers released its third quarter earnings results showing a 19% drop in profits and a $23.9 million dollars in land write-downs.

Wednesday

- Existing Home Sales Report (10 am).

Thursday