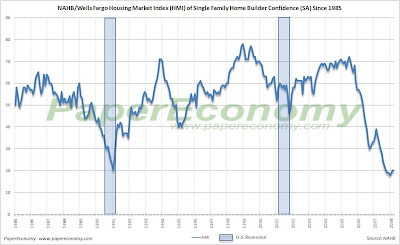

Today, the National Association of Home Builders (NAHB) released their Housing Market Index (HMI) showing continued evidence that the new home market is experiencing a prolonged bout of depression.

Today, the National Association of Home Builders (NAHB) released their Housing Market Index (HMI) showing continued evidence that the new home market is experiencing a prolonged bout of depression.The release came along with a renewed plea for a government bailout of the housing debacle from Chief Economist David Seiders who now suggests that without such measures, the current recession could become more severe.

“While builders continue to report improvements in traffic through their model homes compared with late last year, this activity has not translated to actual sales. That’s where Congress can make a big difference … Measures that stimulate consumer confidence in the housing market, push the fence-sitters into the ring and put a floor under house prices can successfully halt the drag that housing is exerting on the national economy, and help stabilize financial markets at the same time. But such measures need to be implemented as soon as possible in order to limit the severity of the economic recession that now is underway.”

It’s important to understand that sales for the new home market generally peak in the February-April timeframe and that this year’s results have been generally disappointing as noted by Sandy Dunn, current president of the NAHB “With the traditional home buying season now well underway, we have not seen the bump in sales activity that we normally would this time of year,”

Each component of the NAHB housing market index is now sitting at or near the worst levels ever seen in the over 20 years the data has been being compiled strongly suggesting that the current severe contraction has surpassed all other events seen in the last 22 years and is now firmly in uncharted territory.