This post combines the latest results of the Rueters/University of Michigan Survey of Consumers, the Conference Board’s Index of CEO Confidence and the State Street Global Markets Index of Investor Confidence indicators into a combined presentation that will run twice monthly as preliminary data is firmed.

This post combines the latest results of the Rueters/University of Michigan Survey of Consumers, the Conference Board’s Index of CEO Confidence and the State Street Global Markets Index of Investor Confidence indicators into a combined presentation that will run twice monthly as preliminary data is firmed.These three indicators should disclose a clear picture of the overall sense of confidence (or lack thereof) on the part of consumers, businesses and investors as the current recessionary period develops.

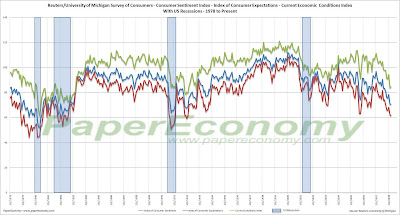

Today’s early release of the Reuters/University of Michigan Survey of Consumers for March confirmed the recent plunge in consumer sentiment falling further still to a reading of 70.5, a decline of 20.25% compared to March 2007.

It’s important to note that this is the lowest consumer sentiment reading seen since the recessionary period of February 1992 which, according to Richard Curtin, the Director of the Reuters/University, indicates that recessionary environment is upon us.

“The Sentiment Index has only been this low during the recessions of the mid 1970's, the early 1980's and the early 1990's … Past declines of this magnitude have always been associated with a subsequent recession”

The Index of Consumer Expectations (an component of the Index of Leading Economic Indicators) fell to 61.4, a whopping 21.98% below the result seen in March 2007.

As for the current circumstances, the Current Economic Conditions Index fell to 84.6, 18.26% below the result seen in March 2007.

As you can see from the chart below (click for larger), the consumer sentiment data is a pretty good indicator of recessions leaving the recent declines possibly predicting rough times ahead.

The latest quarterly results (Q4 2007) of The Conference Board’s CEO Confidence Index fell to a value of 39 with the “current economic conditions” component registering 33.54, the lowest readings since the recessionary period following the dot-com bust.

The latest quarterly results (Q4 2007) of The Conference Board’s CEO Confidence Index fell to a value of 39 with the “current economic conditions” component registering 33.54, the lowest readings since the recessionary period following the dot-com bust.It’s important to note that on every instance that the CEO “current economic conditions” index dropped below a level of 40, the economy was either in recession or very near.

The February release of the State Street Global Markets Index of Investor Confidence indicated that confidence for North American institutional investors increased 6.0% since January while European and Asian investor confidence remained relatively flat to mildly negative all resulting in an increase of 3.5% to the aggregate Global Investor Confidence Index.

The February release of the State Street Global Markets Index of Investor Confidence indicated that confidence for North American institutional investors increased 6.0% since January while European and Asian investor confidence remained relatively flat to mildly negative all resulting in an increase of 3.5% to the aggregate Global Investor Confidence Index.Given that that the confidence indices purport to “measure investor confidence on a quantitative basis by analyzing the actual buying and selling patterns of institutional investors”, it’s interesting to consider the performance surrounding the 2001 recession and reflect on the performance seen more recently.

During the dot-com unwinding it appears that institutional investor confidence was largely unaffected even as the major market indices eroded substantially (DJI -37.9%, S&P 500 -48.2%, Nasdaq -78%).

But today, in the face of the tremendous headwinds coming from the housing decline and the mortgage-credit debacle, it appears that institutional investors are less stalwart.

Since August 2007, investor confidence has declined significantly led primarily by a material drop-off in the confidence of investors in North America.

The charts below (click for larger versions) show the Global Investor Confidence aggregate index since 1999 as well as the component North America, Europe and Asia indices since 2007.