Today, the U.S. Census Bureau released their January read of construction spending again demonstrating the significant extent to which private residential construction is contracting particularly for single family structures.

Today, the U.S. Census Bureau released their January read of construction spending again demonstrating the significant extent to which private residential construction is contracting particularly for single family structures.With the tremendous weakening trend continuing, total residential construction spending fell 19.69% as compared to January 2007 and 34.52% from the peak set in February 2006.

Worse off though was private single family residential construction spending which declined 32.13% as compared to January 2007 and a truly grotesque 49.75% from the peak also set in February 2006.

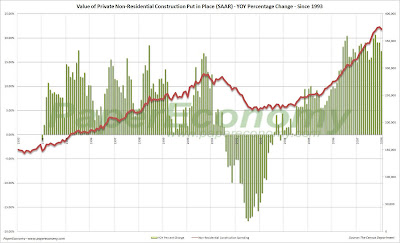

Non-residential construction spending, currently accounting for just under half of all private spending, remains the only pillar of strength falling 1.17% since December but gaining a solid 17.28% as compared to January 2007.

As was noted in prior posts, commercial real estate (CRE) appears to be coming under some pressure with increasing vacancy rates and falling prices.

It's important to note that today’s 1.17% monthly decline in non-residential construction spending was the largest monthly decline since June 2005.

Keep your eye on the last chart in the months to come for a clear indication of an ensuing pullback.

The following charts (click for larger versions) show private residential construction spending, private residential single family construction spending and private non-residential construction spending broken out and plotted since 1993 along with the year-over-year and peak percent change to each since 1994 and 2000 – 2005.