Witnessing the S&P 500 index slide into “bear market” territory has really increased the overall sense of gloom I get when considering the plight of the economy.

Witnessing the S&P 500 index slide into “bear market” territory has really increased the overall sense of gloom I get when considering the plight of the economy.At first I wasn’t sure why I was so surprised… I had been anticipating the housing decline wreaking havoc on the economy for a long while but yet, there was something more ominous in the “twin peaks” chart that just seemed to cut right through all the latest news and developments to the heart of the matter.

To me, it appears that we are dangerously close to having the latest economic downturn being linked so directly to the prior that the two periods inevitably become one.

With only slight caveats, all the recessionary periods preceding the 2001 dot-com recession have generally come with decisive post-recessionary recoveries…. Jobs healed, equity markets healed, housing markets recovered… recessions always bring contraction and retrenchment but they have historically setup a clear subsequent expansionary period.

Now though it appears we may have a different scenario.

First, the post-dot com “expansion” brought with it what appears to be the weakest job growth in at least 60 years.

After expanding substantially below trend on a population adjusted basis since 2003, Non-farm payrolls appear now to have begun to trend down once again (see chart below).

This is a unique era in our post-war history where we have experienced a prolonged period of weak growth that has been unable to come even close to fueling the employment of a percentage of the population comparable to the prior expansion.

Next, the S&P 500 index which broadly reflects the value of (or at least the perceived value of) the private sector is clearly showing a topping pattern that, after climbing out of the abyss of the dot-com collapse, only just breached its nominal prior peak by 37.69 points or 2.47% before turning down substantially into what now appears to be a another bear market sell-off.

Next, the S&P 500 index which broadly reflects the value of (or at least the perceived value of) the private sector is clearly showing a topping pattern that, after climbing out of the abyss of the dot-com collapse, only just breached its nominal prior peak by 37.69 points or 2.47% before turning down substantially into what now appears to be a another bear market sell-off. Finally, after nearly two complete years of a historic housing decline, the general economy appears to be only now catching up with downturn.

Finally, after nearly two complete years of a historic housing decline, the general economy appears to be only now catching up with downturn.Although Wall Street Bulls have been forced to relent, giving up on the “Goldilocks Economy” thesis in the face of the housing and credit meltdown and its obvious effects, it appears that the consensus has still not fully accounted for the severity.

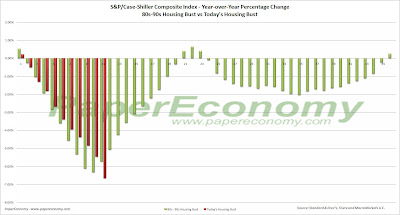

It’s important to understand that home prices have JUST NOW entered a typical “free-fall” phase whereby sellers that have held out reach both a financial and psychological limit and begin to capitulate in the face of tremendously bad headlines and obviously deteriorating circumstances.

It is precisely this significant price decline that will be directly responsible for future churn spurring a new round of the statistically correlated foreclosures, mounting inventory, downgraded securities, declining consumption, sinking stock prices and finally contracting economy.

It is precisely this significant price decline that will be directly responsible for future churn spurring a new round of the statistically correlated foreclosures, mounting inventory, downgraded securities, declining consumption, sinking stock prices and finally contracting economy.